Get the First W-9 Form for FREE! Request W-9 Now

What is the purpose of Form W-9?

The Form W-9, is used by payers to request a Taxpayer Identification Number (TIN) from the individual contractors or freelancers that they hire.

The TIN details provided in the Form W-9 are used by the individuals or businesses to file Form 1099-NEC with the IRS. This form reports the income paid to the contractor or freelancer.

Visit, https://www.taxbandits.com/what-is-form-w9/ to know more details about the purpose of

Form W-9.

What Information should Vendors complete on Form W-9?

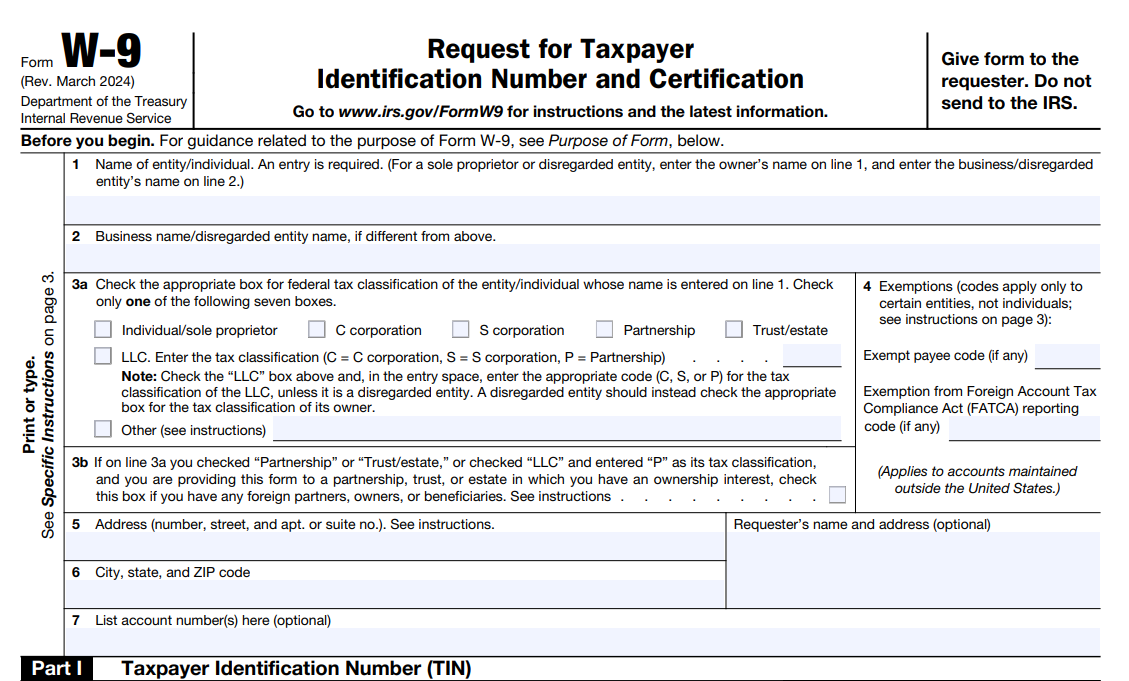

The following information is required to request Form W-9 Online:

- Name (as shown on your income tax return)

- Business name / entity (if you have any apart from the Name)

- Address

- Tax Identification Number

Instructions for Vendors to Request Form W-9 Online

Requesting Form W-9 is easy and straightforward with our Software. Check with the step by step Form W-9 instructions to complete their Form with ease.

Vendors will receive the request through e-mail and complete Form W-9.

a) Line by line instructions of Form W-9

These step by step instructions will help the payee to complete Form W-9,

- Line 1 - Enter the Name as shown on the income tax return

- Line 2 - Enter the Business name/entity other than the name entered in Line 1.

- Line 3 - Check any one of the following seven boxes that applies, based on the following Federal tax classifications:

- Individual/sole proprietor or single-member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/estate

- Limited liability company

- Others

- Line 4 - Exemptions (codes apply only to certain entities, not individuals)

- Line 5 - Enter the current address(with street, apartment or suite no.)

- Line 6 - Provide the City, state, and ZIP code in the space provided

- Line 7 - List your account number (Optional)

- Part I - Enter the Tax Identification Number(TIN). This TIN should match the name provided on the line 1 to avoid backup withholding. For an Individual, it is a Social Security Number(SSN).

- Part II - Certification - Sign and date the Form and send it to the individual or Businesses that requested it from you. Do not send W 9 to the IRS.

Click here, for detailed, line by line instructions to complete W-9 Form.

Request, Receive, and Store Form W-9 with our software

How does formw9instructions.com help with the Form W-9 process?

The W-9 Form process can be completed easily with our software within a few minutes. You can request Form W-9 online one at a time or in bulk if you have a large number of vendors.

Formw9instructions.com is a cloud based application, where you can request W-9 Form efficiently. We have some excellent features that help you to complete your W-9 Form easily.

Our error check feature helps your vendors to identify and correct any basic errors before submitting the W-9 and also helps your vendors to e-sign Form W-9 and submit it.

Once you receive the Form W-9 from the vendor, you can have access to review and approve / deny the Form through our software. Also, the Form W-9 is stored in the secure portal which helps you to retrieve the information when filing Form 1099 at the year end.

Ready to Send a Request to your vendor to complete Form W-9?

Steps to complete your IRS Form W-9 Process with our Software

Form W-9 process can be completed in 3 simple steps

Step 1:

Payers can add the name and email of the vendor and send them a W-9 online request

Step 2:

Vendors will receive the request through e-mail and complete Form W-9 with the required information and submit it.

Step 3:

The payers will be notified once the vendor submits the W-9, which can be reviewed, accepted or rejected.

Ready to Request Form W-9 Electronically with our Software?

Fill Form W-9 online for Free

TaxBandits offers a Fillable Form W-9, which simplifies the process of creating, filling out, downloading, and sharing the w9 forms online. The cloud-based solution performs various validations to identify if there are any errors in your W-9 Form.

If you need to make any changes, you can access and edit your W9 fillable Form Online anytime.

.png)